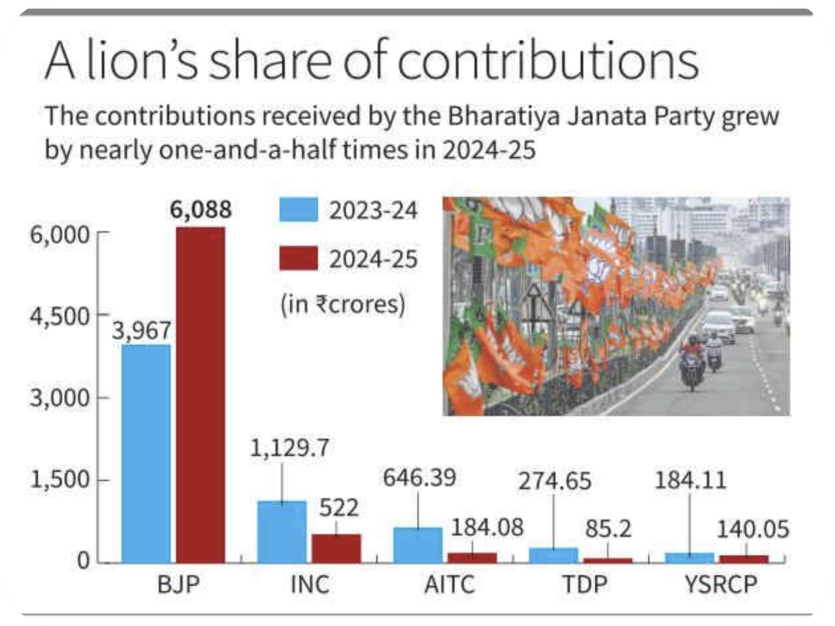

- While several political parties, including the Congress, saw a decline in donations in 2024-25 compared with the previous financial year, the Bharatiya Janata Party saw the contributions grow by nearly one and a half times, according to audit and contribution reports submitted to the Election Commission.

- The BJP received ₹6,088 crore in donations in 2024-25, as against ₹3,967 crore in 2023-24.

- With the scrapping of the electoral bonds scheme, companies have again turned to electoral trusts as a preferred source of political donations for companies in 2024-25.

- In 2023-24, just five trusts reported contributions of a total of Rs 1,218.36 crore.

- In 2024-25, the number of electoral trusts reporting contributions increased to nine. And the cumulative contribution surged to Rs 3,811 crore.

What are Electoral Trusts?

- Introduced by the UPA government in 2013.

- It preceded the electoral bonds scheme that was introduced by the NDA government in 2018.

- Both schemes are meant to facilitate donations to political parties by corporations and individuals.

- But while the electoral bonds scheme sought to ensure donor anonymity, electoral trusts are required to report to the Election Commission contributions from individuals and companies, and their donations to parties every year.

Who can form Electoral Trusts?

Any company registered under the Companies Act can form an electoral trust.

Who can Donate?

- Any citizen of India,

- a company registered in India,

- or a firm or Hindu Undivided Family

- or association of persons living in India, can donate to an electoral trust.

How many Electoral Trusts does India have?

- The no. of registered trusts has ranged from three in 2013 to 17 in 2021-22, but only a few of them can actually make donations every financial year.

- While just five trusts reported contributions in 2023-24, the number increased to nine in 2024-25.

- Of these nine, three trusts — Prudent Electoral Trust, Progressive Electoral Trust and New Democratic Electoral Trust — accounted for 98 per cent of all contributions in 2024-25.

Prudent Electoral Trust, which was known as Satya Electoral Trust before 2017, was by far the biggest, receiving Rs 2,668.46 crore from multiple companies.

Functioning of these Trusts

- Renewal requirements: Electoral Trust must apply for renewal every 3 financial year to continue operating.

- Eligible beneficiaries: Donations can be made only to political Parties registered under sec- 29A of RPA, 1951

- Mandatory Disbursement Rule: At least 95% of total contributions received in a financial year – must be donated to eligible political parties + Remaining 5% may be used only for admin expenses.

- Disclosure of donor Identity:

PAN – mandatory for resident Indian contributors.

Passport No. is required for NRIs at the time of contribution - Mode of Contribution: Via cheques, bank draft or electronic tranfers.

- Transparency: Electoral Trust route is fully transparent – with disclosure of both contributors & beneficiaries.

- Use of Funds: Trust can’t use donations for the benefit of their members or any other purpose.

- Accounting & Oversight:

Trusts must maintain audited accounts.

Disclose donoes + Recipients & disbursement to the ECI.

Question:

Consider the following statements:

a.) Foreign individuals, foreign companies or entities with majority foreign ownership are based from making donations to electoral trust;

b.) Electoral Trusts need to renew their registration every 3 year with the CBDT;

Choose the incorrect option:

1.) Only A

2.) Only B

3.) Both

4.) None

Subscribe Our Youtube Channel: https://www.youtube.com/@CivilsPhodo/