Introduction

In an era defined by shifting alliances and assertive economic policies, the term “tariffication” gained renewed relevance under the Trump administration. Marked by aggressive tariff impositions on major trading partners—especially China—this phase of U.S. economic strategy redefined the contours of global trade. The consequences rippled far beyond bilateral tensions, triggering supply chain disruptions, altering investment flows, and compelling nations to rethink their economic diplomacy.

As the world grapples with the aftershocks of this protectionist pivot, a new wave of diplomacy—Rapprochement 2.0—is attempting to recalibrate fractured economic ties. This blog explores the roots and rationale of Trump’s tariff-centric approach, its broad-based impact on the global economy, and the early signs of reconciliation emerging in a multipolar world struggling to balance competition and cooperation.

Context

- US President Trump is set to announce reciprocal Tariffs on the rest of the World on 2nd April

- Trump is going to celebrate the day as Liberation day.

- Policymakers and Investors across the world are anxious as no one has any clarity on how reciprocal tariffs will be calculated. For instance,

- Whether domestic subsidies will be factored in or not.

- What about tax incentives?

- What about non-tariff barriers?

- Today Indian market has responded negatively to this as Sensex has fallen by more than 1.5%

Contents

- What is Tariffication and Reciprocal Tariff?

- Why is Trump doing that?

- Identifying the solution

- Who will bear the brunt of it?

- Way Forward

Tariffication

- It refers to the process of converting non-tariff barriers to trade, like import quotas, into tariffs, which are taxes on imported goods.

- WTO, though promotes free trade, allows tariffication for the shake of transparency as well as to accommodate genuine need of protection of many developing countries.

What is Reciprocal Tariff?

- A Reciprocal Tariff is a tax or trade restriction that one country places on another country in response to similar actions taken by that country.

- The idea behind reciprocal tariffs is to create balance in trade between nations.

- Reciprocal tariffs can lead to a back-and-forth increase in trade barriers, potentially resulting in a trade war that negatively impacts both economies.

- Such situations can disrupt supply chains, raise prices for consumers, and slow down economic growth.

Why is Trump doing that?

There are at least 2 trigger points for Trump:

- The US trillion dollar trade deficit (i.e. the gap between the value of its imports and exports)

- Over valuation of the USdollar: Because it is the default currency for the world and as such its demand never falls, not even when the US economy struggles.

Impacts of Overvaluation of the US Dollar

- Positives

- Strong purchasing power to import goods from anywhere in the world.

- Ability to borrow at very low interest rates.

- Ability to sanctions and shut out any foreign country from the international financial order dominated by the US.

- Negatives

- Makes US exports less competitive

- Makes US imports cheaper

- Handicaps American manufacturing.

- Decline of local economies.

Identifying the solution

There are two solutions:

- Devaluation of the dollar – As USA did it back in 1985 through the Plaza Accord.

- Use of Tariffs – Trump is more inclined towards the use of tariffs.

Who will bear the brunt of it?

There are two view points:

- Conventional view point – It says tariffs are paid by domestic consumers and that they will lead to inflation.

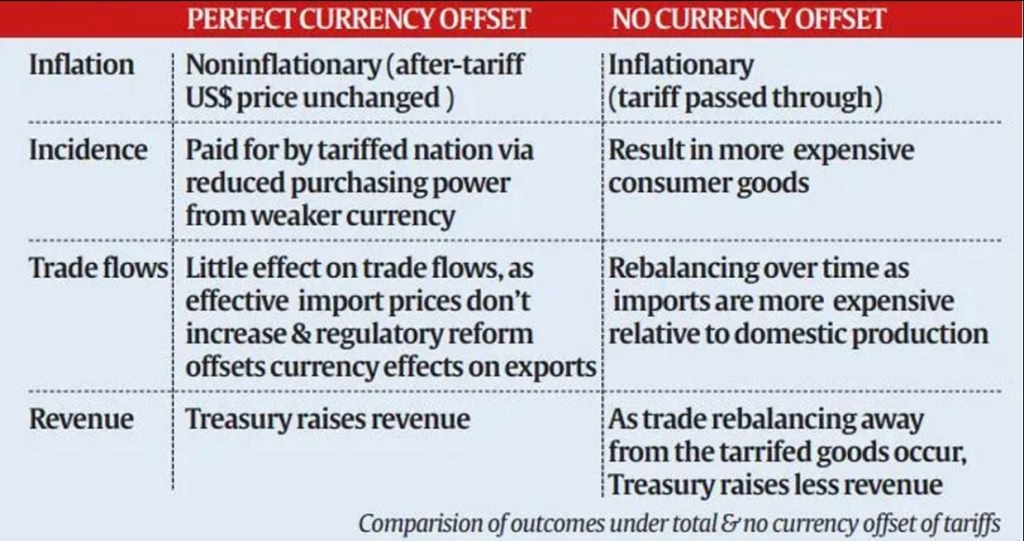

- Trump view – Make tariffs to be paid by foreign countries as the exchange rate offsets the tariffs and hence, non inflationary through two different ways:

- Reallocation of aggregate demand from other countries to America.

- And increase in revenue to the US treasury.

Note: A combination of both ways can help America to bear the increasing cost of providing reserve assets for a growing global economy.

These are the two expected scenarios:

Impact on India

- Global Trade Research Initiative assessed the potential impact at four levels:

- Country level – A uniform tariff on all Indian exports

- Separate tariffs for agriculture and industry

- Sector-level tariffs

- Grouping all products into 30 categories

Note: In all these scenarios, India is going to be a net loser.

- Country level – A uniform tariff on all Indian exports:

- If the US imposes a single tariff on all products from India, it would be an additional 4.9 per cent.

- Currently, US goods face a weighted average tariff of 7.7 per cent in India, while Indian exports to the US attract only 2.8 per cent, leading to a 4.9 per cent difference.

Implications for Rapprochement 2.0

- First, will undermine USA willingness to carryforward globalization.

- Second, may allow European countries as well as emerging economies for de-dollarization.

- Third, may allow china to occupy strategic space

- Fourth, the overall implications of first three are the decline of American hegemony and overall negative impact for rapprochement 2.0.

- There would be more strategic convergence between china and other developing countries, directly hampering American interests.

Way Forward

- Though perfect currency offsetting the USA wants, the problem is it will make the USA dollar more overvalued.

- In other words, tariffs made the problem worse.

- So, Trump should not impose tariff.

- Instead it can go for devaluation of the dollar.

- Further, USA’s changed world view requires USA to align with more countries and reciprocal tariff would go against US core interests (Rapprochement 2.0).

Conclusion

Trump’s tariffication strategy disrupted global trade norms, triggering economic uncertainty and strategic realignments. As nations adapt, Rapprochement 2.0 signals a cautious return to dialogue and cooperation—marking a pivotal shift from confrontation to recalibration in global economic relations.

Join Our Telegram Channel: UPSC With Deepak Prakash